income tax calculator india

You can calculate your Annual take home pay based of your Annual gross income Education Tax NIS and. With the announcement of the new tax slabs that will be an open option starting from April 1st 2020 Zoho Payroll income tax comparison calculator has been designed to help you get a.

Fill in your basic information which is divided into three categories.

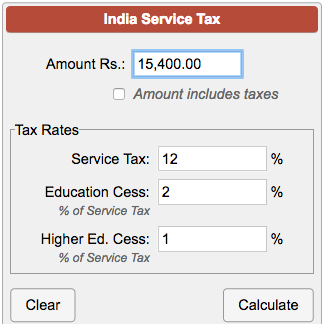

. Select the financial year from FY 2021-22 AY 2022-23 or previous FY 2020-21 AY 2021-22. Progressive slab or 20. Taxmanns Income Tax Calculator helps you compute the taxable income and tax liability under the Income-tax Act.

50 of Basic Salary. INCOME TAX CALCULATOR FY 2022-23 AY 2023-24 Calculate income tax on your earnings in a few simple steps Basic details. The Indian Annual Tax Calculator is updated for the 202223 assessment year.

1 lakh without indexation benefit. 10-IJ and Form No10-IL are available for filing on the portal. Select your Age bracket and your Residential.

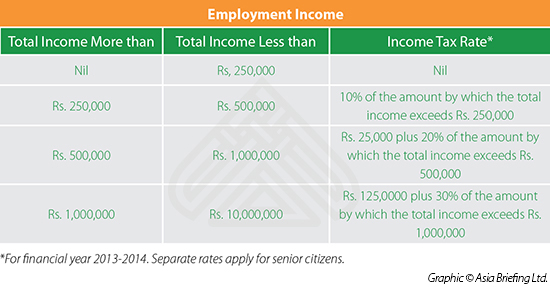

This calculator provides comprehensive coverage for every type of. 125000 30 on the amount by which taxable income exceeds Rs. If population exceed 25 Lakhs.

Income Tax Calculator - Calculate Income Tax FY 2021-22 AY 2022-23 2022-23 2021-22 with Tax2Win Income Tax Calculator. The Indian Tax Calculator calculates tax and salary deductions with detailed tax calculations and explanations based on the latest Indian tax rates for 20222023 assessment year. Rule 2A says that sec 80ttb of the Internal Revenue Code does not count as taxable income the less of the following.

Use Income Tax Calculator in India for free. 10 of salary minus rent paid by employee. To Calculate the Income Tax liability in India.

The following are the instructions for using the tax calculator. The Income Tax Department NEVER asks for your PIN numbers. Income Tax India.

15 of salary minus rent paid by employee. We hope our free income tax calculator india was able to. Income from house property.

10 of salary minus rent paid by employee. If population exceeds 10 lakhs but up to 25 lakhs. To stay updated.

If population exceed 25 Lakhs. HRA that the company gave them. Ask 1800 180 1961 1961 Income Tax Department.

Bank of India has been migrated from OLTAS e-Payment of. Skip to main content. If population exceeds 10 lakhs but up to 25 lakhs.

15 of salary minus rent paid by employee. Income-tax at the rate of 10 to be levied on long-term capital gains exceeding Rs. Using a free online income tax calculator helps gain insight into the current.

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Saver Calculator India

Income Tax Calculator Fy 2019 20 Ay 2020 21 Insurance Funda

All India Postal Stenographers Association Income Tax Calculator For Fy 2019 2020

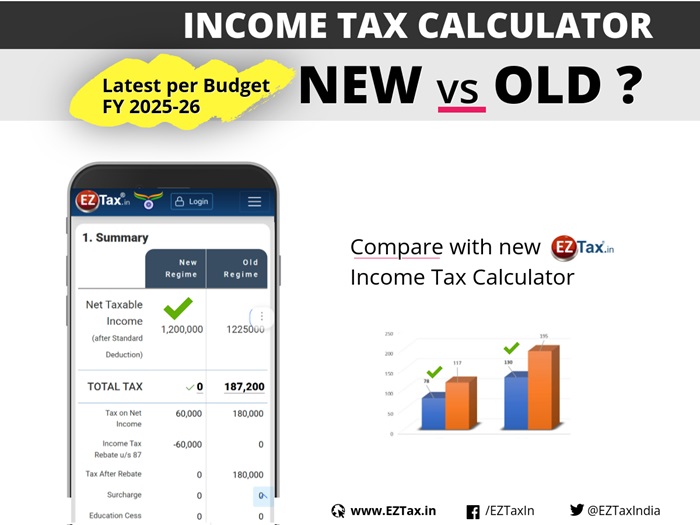

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Tax Calculator For India Visual Ly

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

How Do I Calculate My Income Tax In India When I M New To Salary Components

Calculating Expatriate Income Tax In India Asia Business News

How To Calculate Income Tax On Salary With Example

New Vs Old Tax Slabs Fy 2022 23 Which Is Better Calculator Stable Investor

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculator For Taxpayers

Income Tax Calculator Calculate Income Taxs Online Fy 2021 22 The Economic Times

Download Automated Income Tax Calculator For The Financial Year 2020 2021 And Assessment Year 2021 22 On The Basis Of The Budget 2020 Optin As Old Tax Regime Apna Tax Plan

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube